The Only Personal Finance Tracking Software

That Gets Your Finances Together

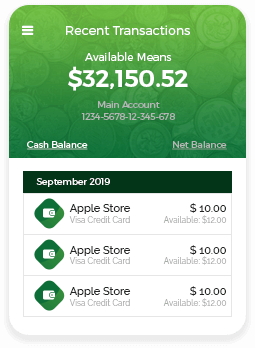

As a free online personal finance software and web app, My EasyFi organizes your money like never before. With an intuitive interface and an aesthetic design, this expense tracking software lets you control your money in-and-out. And for those who earn money from gaming, such as slots, My EasyFi seamlessly integrates these earnings into your financial management system. Whether it's winnings from the best online slot games or other sources, My EasyFi helps you track and manage your money effectively. Experience the convenience of managing your finances, including earnings from popular gaming platforms like เว็บสล็อตที่ดีที่สุด, with My EasyFi today!

-

Create a seamless monthly budget

-

Keep track of all of your expenses

-

Find hidden ways to get rid of your debt

-

Easily build your savings for the future

-

Earn through an easy affiliate program

-

And much more!

You can:

We Bring Your Money Together

Life feels good when you have control over your finances. About one-third of American households maintain their budgets, including their savings and investment goals.

My EasyFi is your personal expense tracking software that puts a halt on all your money hassles. Let’s manage your money conveniently anywhere, anytime.

Handle Your Expenses The Way You Want

With our personal money management software, we help you understand the language of expenses. Just add your income and monitor everything from your dashboard. We also support Casino Management Systems (CMS) to manage casino players' daily operations, security systems, and assets. The CMS serves as the central hub for all casino transactions. You can also visit casinoohneverifizierung.org if you are looking for the best casino game offers and generous bonuses.

Update your expenses as you go; this expense tracking app will display the current money details instantly.

We Care About Your Money

Our expense tracker is a one-way platform that helps you know your money better.

Cruise along My EasyFi features and discover what's been missing all along. We care about you; we care about your money.

Join Us NOW